A guide to finding financial support for your new career. Financial Support is available for you…

Step 1. The Technical Support Grant at your Local Social Welfare Office

Step 2. Enterprise Allowance Grant at your Local Social Welfare Office

Step 3. Trading Online Voucher with your Local Enterprise Office

Step 4. Insurance with AIT, Ireland, and the UK’s largest Membership

Step 5. Register Your Business Name at the Company Register Office

Step 1 Explained – Technical Support Grant

The Training Support Grant is aimed at providing quick access to short-term training or related interventions. Here’s a summary:

Key Features:

Purpose: To help jobseekers obtain or renew certifications and permits for identified work opportunities or address immediate skills gaps.

Eligibility: Available to anyone on a social welfare payment.

Value: Up to €1,000 per year.

How to Apply:

Contact: Call your local social welfare office.

Appointment: Request an appointment with your case officer.

Application Process:

Appointment with Case Officer:

Inform your case officer that you are interested in the Technical Support Grant.

Request the necessary form.

Course Details:

All courses are accredited.

Insurance is provided by AIT (Associated Irish Therapists).

Submitting the Form:- You can either drop off the form in person or post it to the following address:

Postal Address:

AINTNAILZ

Church Street

Tullamore

Co. Offaly

This grant can effectively support your journey toward securing employment by enhancing your skills and certifications.

Click the link below for all the information: https://www.gov.ie/en/publication/0a962-operational-guidelines-training-support-grant

Step 2 Explained – Enterprise Allowance Grant

After you complete your course, you can apply for the Enterprise Grant to start your new business.

Click here for more information or to apply if you are eligible: https://www.gov.ie/en/department-of-social-protection/services/enterprise-support-grant

After you complete your course. You can avail of the Enterprise Allowance Schemes. For this step, you will need to make an appointment with a case officer at your local Social Welfare Office

Grant Overview

The Back to Work Enterprise Allowance (BTWEA) scheme is an excellent opportunity for anyone seeking to become self-employed. The scheme allows you to keep a percentage of your social welfare payment for up to 2 years (100% for the 1st year and 75% for the 2nd year). You can apply online or pop into your local social welfare office, fill out the form, and you will get an appointment to meet with a Case Officer who will assess your suitability for the scheme.

In addition, there is a grant worth €2,500 that can be used for different services, such as accountant fees, equipment, e.g., table, beauty couch, chairs, stationery, basically any equipment or service that you may need to start your new business.

When you are successful in your application for the Back to Work Grant, you will also be appointed a business and life coach from your Local Development Company. together, you develop a business plan, which includes finances, profit & loss predictions, insurance, equipment, etc.

Step 3 Explained – Trading Online Voucher (If you’re not interested in a website, skip this step)

Click this link for all information: https://www.localenterprise.ie/Discover-Business-Supports/Trading-Online-Voucher-Scheme/

The Trading Online Voucher scheme is funded by the Department of Enterprise, Trade, and Employment (DETE) and is aimed at established micro businesses, including sole traders, with little or no trading online capability.

The scheme offers a grant of up to €2,500 (subject to match funding) to help micro-enterprises (10 employees or less) to develop their e-commerce capability, and in turn, reap the positive enterprise impacts of trading online.

Only applications made online via the “Apply Now” link below will be accepted and provided the half-day Information Seminar has been completed.

Step 4 Explained – Business Name

Register Your Business Name with the Company Register Office in Dublin

Click the link to get started: https://www.cro.ie/About-CRO/Overvie

This step can be done online; it’s a quick and easy process. “I always recommend registering your business name with the Company Registration Office as soon as you decide to start your new business.

Step 5 Explained- Insurance

Insurance with AIT (Associated Irish Therapists)

Click this link for all information: http://www.abtinsurance.ie/NailsTanning-and-Makeup

Firstly, start with student insurance. When you qualify and feel confident to start your business and start charging for your work, you can get Individual Nails, Tanning & Makeup Insurance with ABT.

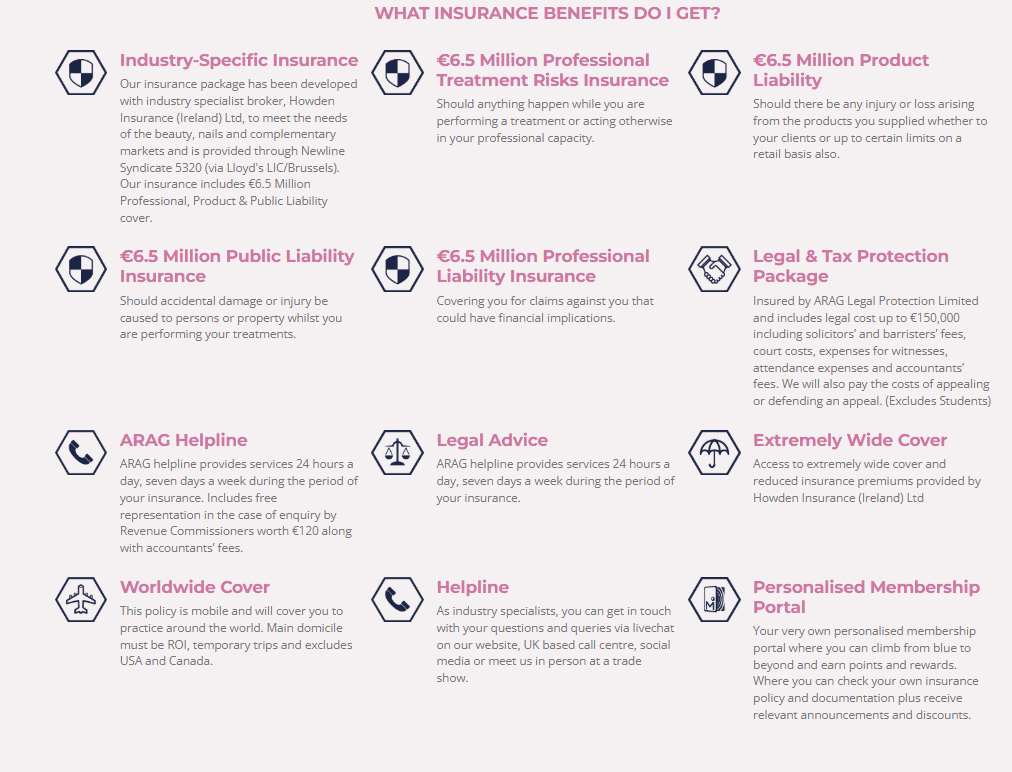

Benefits include:

-Up to €6.5 million Professional Treatment Risks Insurance should anything happen while performing a treatment or acting otherwise in your professional capacity

-€6.5 million Public Liability should any accidents occur

-€6.5 million Product Liability should there be any injury or loss arising from the products supplied, whether to clients or up to certain limits on a retail basis.

Insurance Benefits

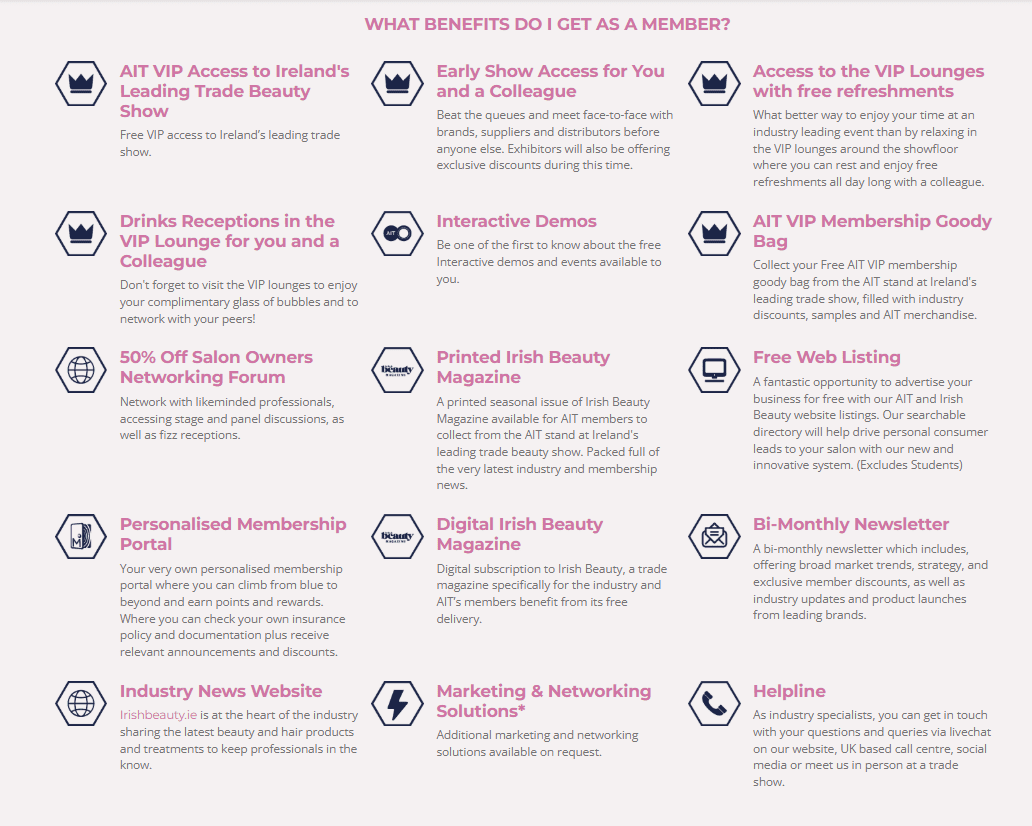

Membership Benefits

Hey! I’m ”Deborah”

When starting your business in 2026, there are several financial and practical supports available to you. This page is a quick guide to support that you may not have been aware of.

From course fees to starting your own business, the planning and preparation stages can be daunting, but there is amazing support if you know where to find it.

If you want to discuss any of the steps above, email info@aintnailz.ie or call Deborah directly on 0877998915.

Let’s keep in touch

What our students say

6-WEEK GEL TECHNOLOGY COURSE

Huge thanks to @aintnailz for her support and guidence on helping me get my nail technology certificate! So grateful and excited for what’s next!

Lucy O’Brien.

@https://www.instagram.com/nailedbyylucy/

12-WEEK COMPLETE NAIL TECH COURSE

This course with Deborah was amazing dedicating a couple of hours a week to your practice really helps you to improve quickly under her guidance I flew through my course learning how to do both gel and acrylic which has greatly benefited me as my clients can choose between both. The happy and cheerful atmosphere of Deborah’s classes allows you to relax when you walk through her doors, if you are thinking of doing any courses Deborah is who I’d call

Elaine Conway.

@nailz_byelaine

12-WEEK COMPLETE NAIL TECH COURSE

At my age, doing the 12-week nail tech course was a bit daunting at first, but I have to say I enjoyed every minute of it. Deborah is an amazing teacher and made learning a new skill very enjoyable. I would recommend anyone who is upskilling to give this course a try; it is definitely worth the effort and the time.

Gillian McD.